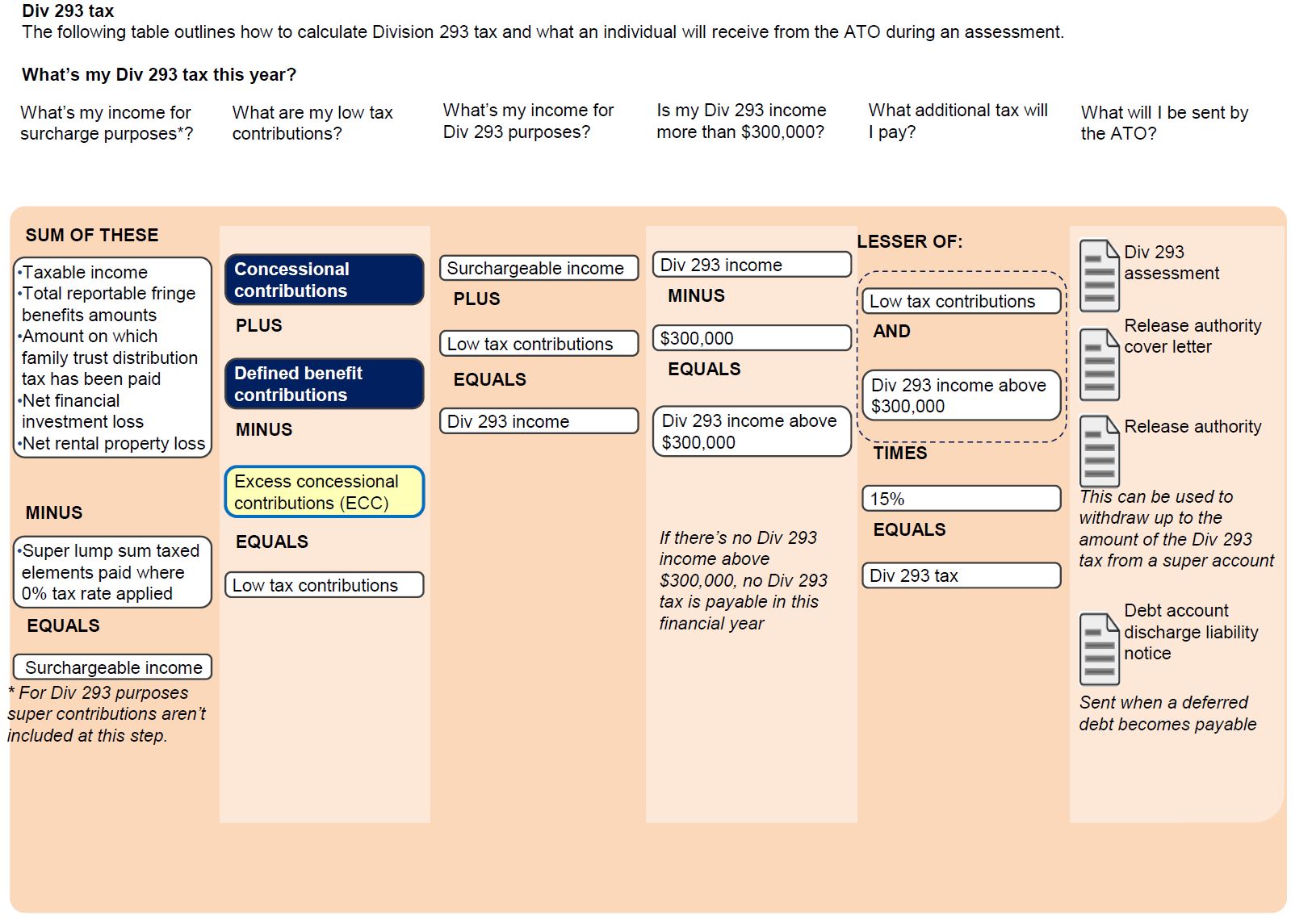

Question of the month - Division 293 tax and carry forward concessional contributions - FirstTech Podcast | Acast

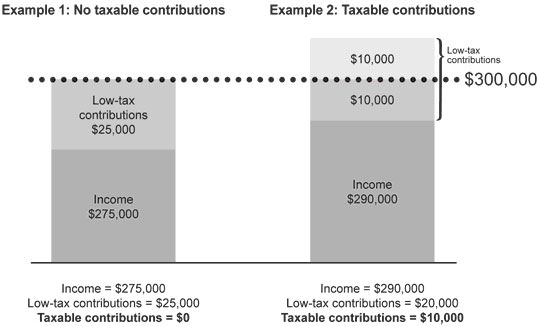

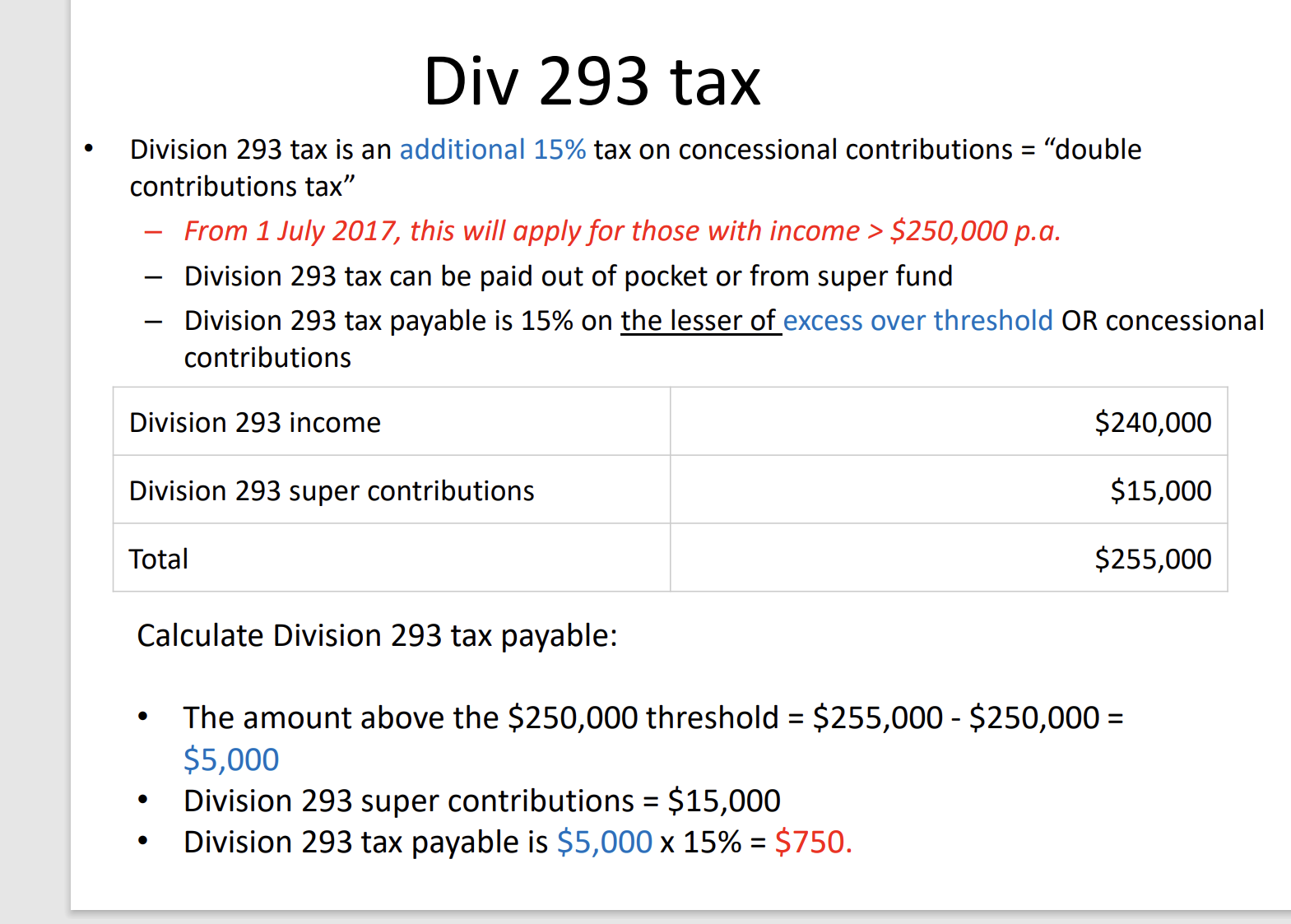

📝Div 293 tax: Earn special tax on super contributions. Contact me or Daniel Creagan. | Vivi Chen posted on the topic | LinkedIn

Hoffman Kelly Explains: Division 293 Tax – Additional Tax for High Income Earners - Hoffman Kelly | Accounting Service | Brisbane | Stones Corner